|

As a financial advisor, digital marketing can be a minefield of compliance issues. Advice you may receive from a marketing agency or various sites like Neil Patel do not consider the penalties you could run into if you use some of their tactics. One of the big issues we often run into while working on SEO for Financial Advisors is the grey area that exists around reviews. When we're talking the most popular search engine in the world (Google), the main concern is Google My Business reviews. Are you allowed to receive reviews on Google as a financial advisor? The answer is, as usual, it depends. DO REVIEWS MATTER FOR FINANCIAL ADVISORS?Regardless of the regulations, consumers use reviews to make educated decisions. According to a recent study conducted by BrightLocal, 82% of consumers surveyed say that they use online reviews before choosing who to do business with. There is no reason to believe this is any different for financial advisors and RIAs. Reviews also make up 15%-25% of the factors that decide which businesses show up first for searches like "Financial Advisors Near Me". They also account for 6%-17% of the factors that decide which websites show up organically. CAN A FINANCIAL ADVISOR RECEIVE REVIEWS?As you know, some advisors are primarily regulated by FINRA, some are primarily regulated by the SEC and some have to answer to both. It is generally good practice to be aware of guidance by both organizations to avoid compliance issues. The current stance from FINRA is that you can receive unsolicited third-party opinions or comments on social media. This would apply to Google My Business reviews as well. FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in However, it is important that those reviews are indeed unsolicited. There are a lot of services out there (that work very well) for increasing your number of reviews, but we've already seen advisors being penalized for this behavior. We sell "review generation" services to other industries. There is a reason we don't recommend this service to financial advisors or RIAs. In mid-2018, there was an advisor in California fined for related behavior. You can read that case here. This is from the SEC, which has still not made it entirely clear what their stance is on the issue. They have stated that they are considering Amendments to the Marketing Rules Under the Advisers Act which would clear up and potentially change a lot of these guidelines. In the case mentioned above, the advisor seems to have crossed the line in a few key ways:

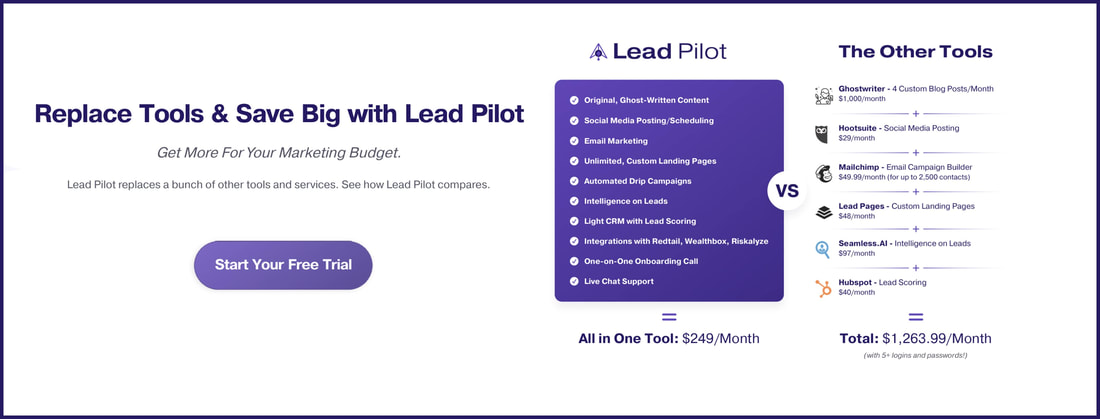

KEY TAKEAWAYS1. As a broker-dealer FINRA has clearly stated that you are allowed to receive unsolicited reviews. 2. You absolutely should not respond to reviews or share these reviews elsewhere. 3. The SEC's guidelines are less clear, but will likely be updated soon. 4. We recommend financial advisors should not purchase reputation management services. This is a topic that we keep a close eye on. Once the proposed new SEC rules are approved, we will be providing updated coverage. We are an ambassador for Lead Pilot and receive a small comission for referring users to what we think is the best lead management tool for financial advisors.

1 Comment

2/9/2024 10:55:59 pm

Thanks for sharing this valuable blog! I've been searching for information like this, and your blog on Google reviews for financial advisors is really interesting. I hope you'll continue to post similar blogs in the future. Keep up the good work and keep sharing!

Reply

Leave a Reply. |

PopularCategories

All

|

RSS Feed

RSS Feed